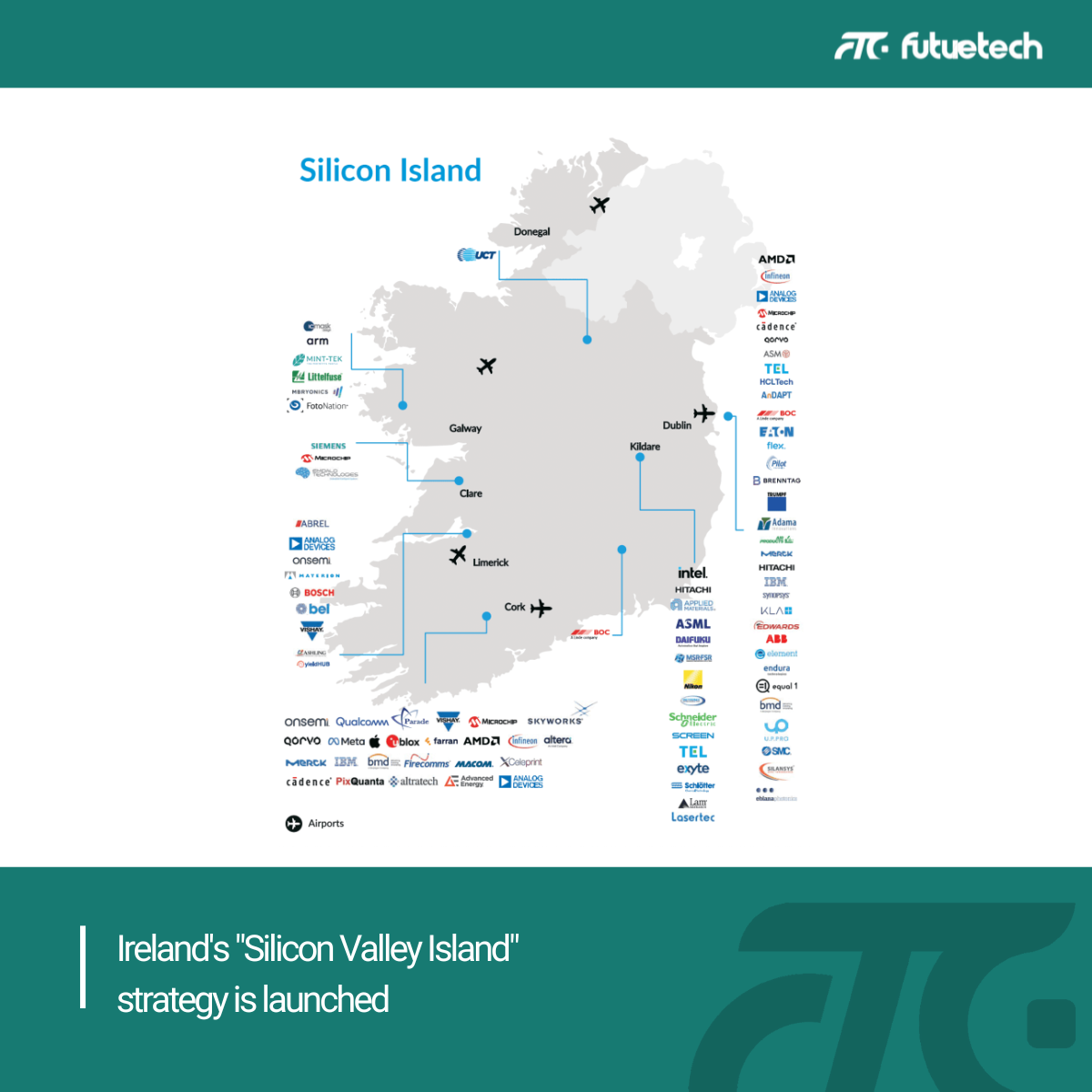

Ireland has unveiled its national semiconductor strategy, known as “Silicon Island,” positioning itself as a key player in the global chip industry and supporting the goals of the EU Chips Act. This move not only underlines Ireland’s commitment to technological innovation but also reflects a wider shift in the global semiconductor landscape—one that emphasizes resilience, diversification, and regional capacity-building.

A National Push to Support Europe’s Semiconductor Goals

Launched by Minister for Enterprise, Trade and Employment Peter Burke, the “Silicon Island” initiative aligns closely with the EU Chips Act, which aims for Europe to account for 20% of global chip production by 2030.

Ireland already has a strong foundation, with over 130 semiconductor-related companies, supporting 20,000 jobs and generating €13.5 billion in exports. The government expects to add up to 34,500 new semiconductor jobs by 2040, backed by more than €70 million in national and EU funding. These funds will support the Tyndall National Institute in three EU pilot programs, help establish the I-C3 National Competence Centre, and strengthen cooperation through the IPCEI on Microelectronics, alongside companies like ADI and 14 EU countries.

“Ireland is investing in a sector that’s critical to future innovation and economic growth,” said Burke. “This strategy reflects our ambition to play a leading role in the semiconductor space and contribute meaningfully to Europe's chip goals.”

Global Impact: A More Balanced, Secure Semiconductor Supply Chain

Ireland’s initiative is part of a growing global trend: building more geographically diverse semiconductor hubs. For decades, the industry has been heavily concentrated in East Asia. Now, governments and companies are looking to spread out production and reduce risk, especially in light of recent supply disruptions and geopolitical uncertainty.

Ireland is home to major industry players like Intel, ADI, and Qualcomm, and all three top EDA companies—Cadence, Synopsys, and Siemens—operate there. This makes the country one of the few locations with a full-value-chain ecosystem, from chip design and R&D to manufacturing and packaging.

For global customers, this means:

● More sourcing options across regions

● Greater protection against single-point supply failures

● Improved lead times for critical sectors like automotive, energy, and industrial electronics

Innovation and Opportunity for Startups and SMEs

While large corporations are central to the “Silicon Island” story, Ireland’s strategy also creates space for smaller companies and startups. The country has a long history in semiconductors—starting with ADI in the 1970s—and has since built a strong environment for innovation.

The Tyndall National Institute plays a key role here, supporting both research and early-stage companies. Examples like Firecomms and InfiniLED (now part of Meta) show how Irish startups can scale globally. The country is also attracting international startups that see value in Ireland’s infrastructure, expertise, and access to EU markets.

Futuretech Components’ View: Distribution in a Multi-Hub World

At Futuretech Components, we believe this shift toward regional semiconductor ecosystems will redefine how the global supply chain works. As Ireland and Europe strengthen their position in the chip sector, a more distributed, responsive, and collaborative supply network is emerging.

To support this trend, Futuretech is expanding its global sourcing network and working closely with trusted manufacturers across Europe, Asia, and North America. Our goal is to provide customers with timely, flexible, and secure access to critical components—regardless of where they are in the world.

As the industry evolves, we remain committed to bridging global supply with local demand, and to helping customers navigate this new era of electronics with confidence.